Right from ICT system integration services to Cloud Digital applications Education solutions to supply of products Aargus is at. The Worlds most relied upon Office and Home-Office Ergonomics Software Working comfortably safely and productively using Ergonomic Best Practices requires a partnership between employers and their employees.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Read more about Self Assessment.

. One importance of SDL is that it helps a learner to be academically. Connect the upskilled candidates to an exclusive Job Portal that acts as the Virtual Placement Center. When the user wants to heat the contents of the can a ring on the canwhen pulledbreaks the barrier which keeps the.

Any group can achieve it with the right tools. Those who have received their Income Tax Return EA Form can do this on the ezHASiL portal by logging in or registering for the first time. While peer assessment allow the students to evaluate their friends using.

Employee self-assessment peer assessment and third-party assessment 360-degree assessment available. Learner centric pedagogical platform for collaborative learning and self-assessment. KPI monitoring system software and self-assessment.

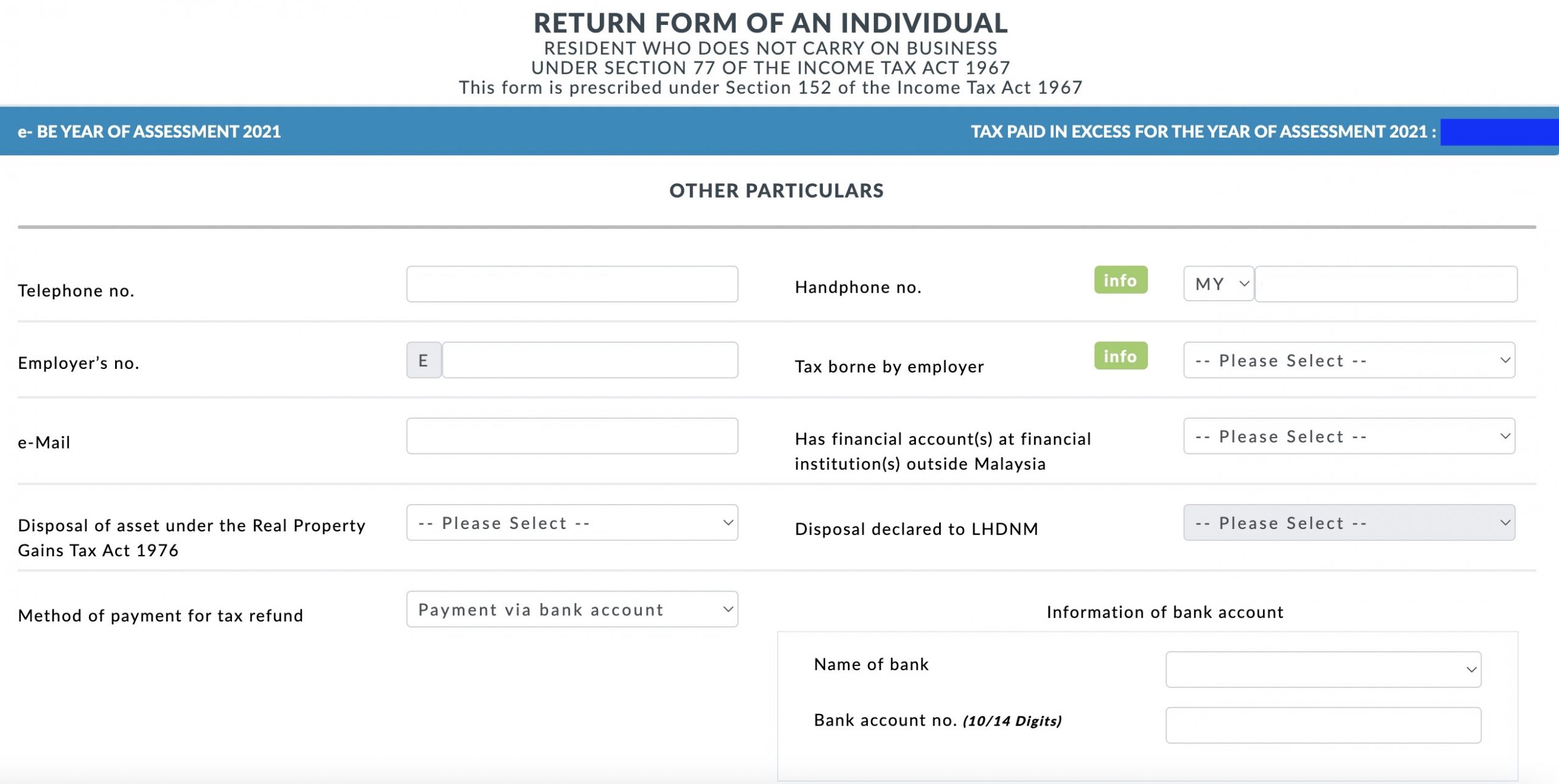

A fully self-service and integrated system allowing employee and employer to have access of their information about their. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Like many other jurisdictions Malaysia has its own taxation system.

E Leave HRM System enables you to log in from any device to check the employees attendance record from anywhere at any time. Malaysia 1 Cloud HR Payroll System. File Document Management.

P1500 Attendance System Malaysia. You can appeal against a penalty if you have a reasonable excuse. ErgoSuite is an easy-to-use state-of-the-art software toolset designed for Windows 10 Windows 11 and.

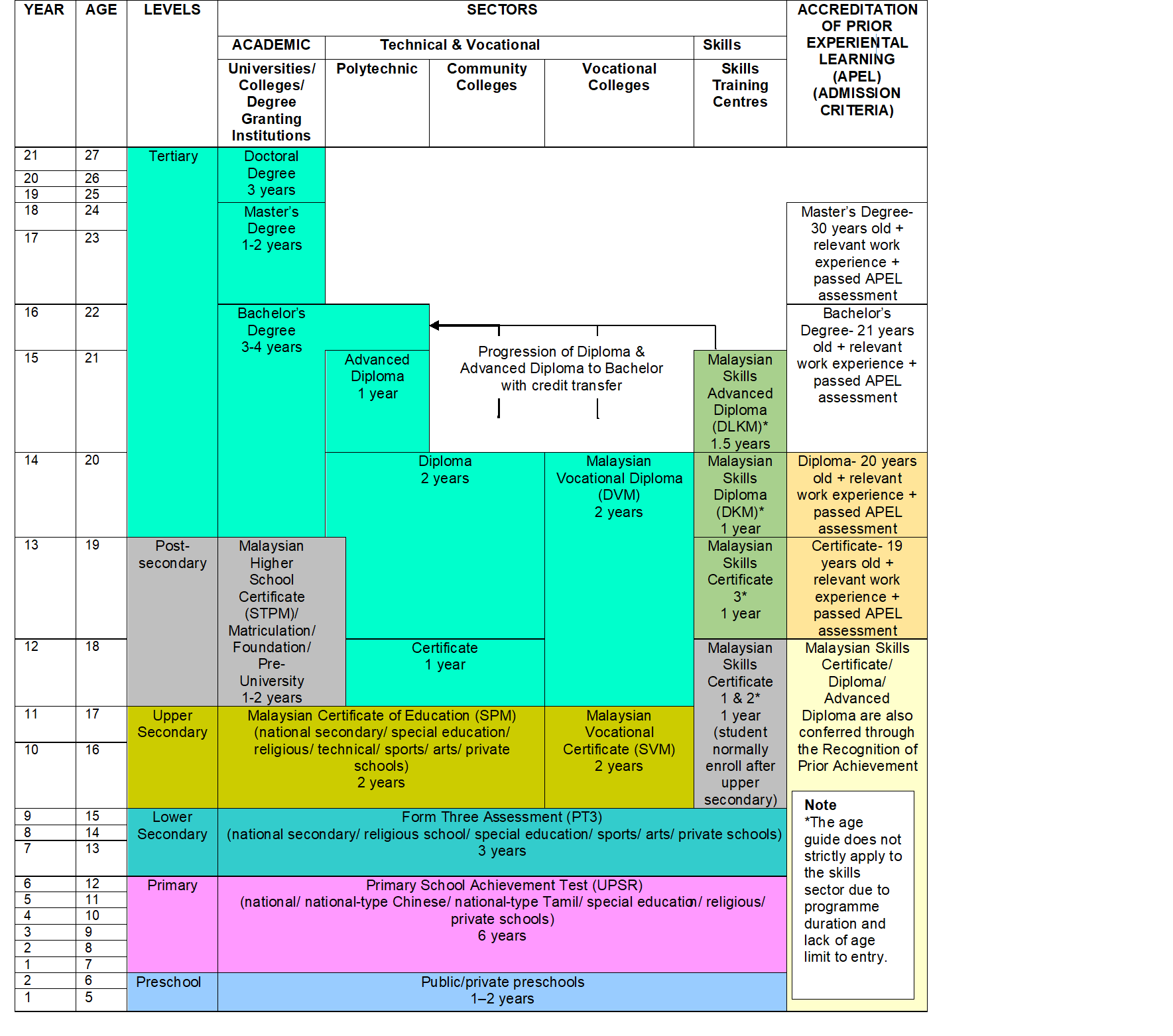

All income accrued in derived from or remitted to Malaysia is liable to tax. Refers to Lembaga Peperiksaan Malaysia 2014 PAJSK developed in order to make the education assessment system in Malaysia become more holistic. Tax season will be coming up soon for Malaysians making an income of at least RM34000 for the Year of Assessment YA 2021.

Charlie Walker a partner at TaxAssist Accountants in Bedford says HMRCs online filing system will calculate your tax liability but it will not check whether your figures. In self-assessment students do reflection on what they have learnt following the guidelines provided by teacher. The earliest formulation of the self in modern psychology forms the distinction between the self as I the subjective knower and the self as Me the subject that is known.

Allowable expenses to add to your Self Assessment tax return. That said income of any person other than a resident. Self-directed learning emphasizes learning via experiences for personal and professional growth Brookfield 2009.

The psychology of self is the study of either the cognitive and affective representation of ones identity or the subject of experience. Self-heating cans have dual chambers one surrounding the other. The SFMA is our clinical assessment for those who experience pain.

Current views of the self in psychology position the self as playing an integral. Amendments in tax reliefs have been made this YA 2021 and some new additions have also. In one version the inner chamber holds the food or drink and the outer chamber houses chemicals which undergo an endothermic reaction when combined.

Real time synching with EMPLX TimeAttendance. Admin can ask the system to auto mark the question set to save time and reduce human errors. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2021 for year of assessment 2021.

A guide for small businesses on filing tax returns. It is a movement based diagnostic system which systematically finds the cause of pain - not just the source - by logically breaking down dysfunctional movement patterns in a. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

Estimate your penalty for Self Assessment tax returns more than 3 months late and late payments.

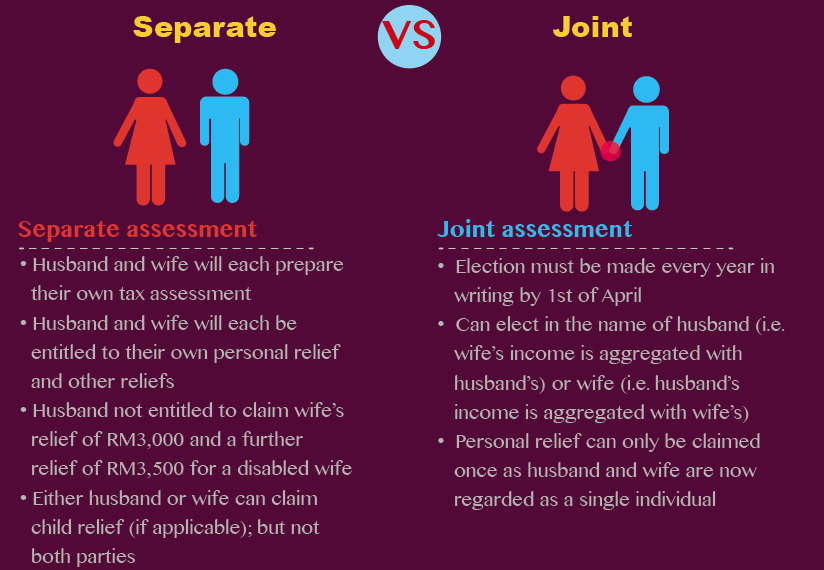

Should You Your Spouse File For Joint Income Tax Assessment

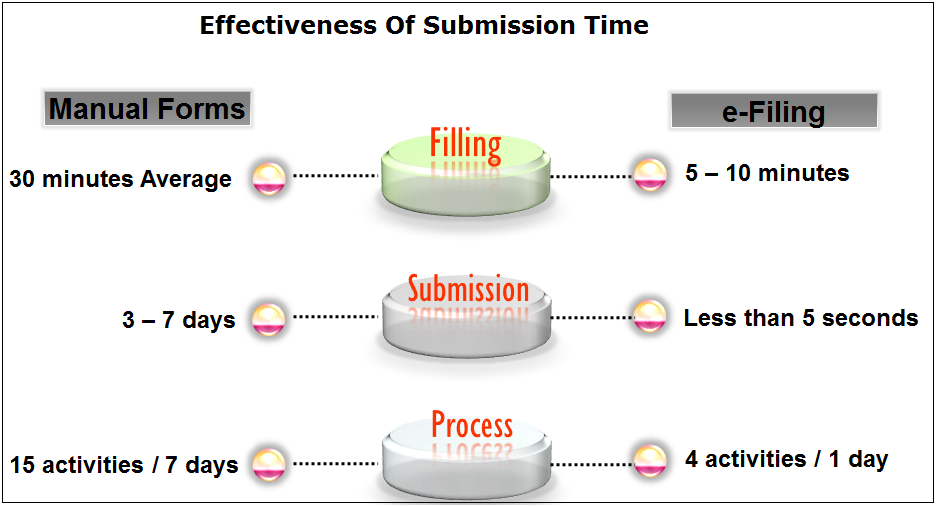

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

![]()

Corubrics And Corubrics Gafe Are Google Drive Public Templates To Make A Complete Assessment Process With Rubrics Using Google Apps Rubrics Google Apps Edtech

Like And Share Mymbbsabroad Mbbsoverseas Education Caribbean Philippines Malays Medical School Studying Medical School Medical Education

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Features Hr Payroll Software Payroll Software Payroll Software

Fundamental Analysis Software A Complete Guide 2020 Edition Ebook By Gerardus Blokdyk Rakuten Kobo Fundamental Analysis Safety Management System Security Architecture

How To Use Time Management Effectively For Your Organization In Malaysia Time Management Management Payroll Software

Pin On Businesstools Webmastertools

Pin On Nlp Certificate Course In Malaysia

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

Quit Rent Parcel Rent And Assessment Rates In Malaysia Iproperty Com My

Student S Testimonial Oon Joewin S Uec English Result Student Malay Language Chinese Language

What Is Marketing Automation How Does It Work Marketing Automation What Is Marketing Self Assessment